Sound Strategy Anticipates Consumer Demand

Financial institutions that offer robust consumer services operate in a market shaped by emerging technologies and consumer preferences. Banks and Credit Unions perform an essential function for their communities and individual customers and members. So when clear trends in consumer behavior appear, financial institutions are wise to respond accordingly.

For the ten years leading up to 2020, the consumer banking industry witnessed steady trends toward online and mobile banking. During this time span, the rate of “unbanked” households fell from 8.2% in 2011 to 5.4% in 2019.

These insights and more were revealed in a 10-year FDIC survey conducted from 2009 to 2019. Financial Institutions across the country consider these long-term trends as they make strategic decisions for the future. Additional insights from the past two years have revealed that many long-term consumer trends were accelerated by the pandemic. These more recent developments help banks and credit unions gain a more complete picture of what the future holds.

Key Trends that Impact Financial Institutions

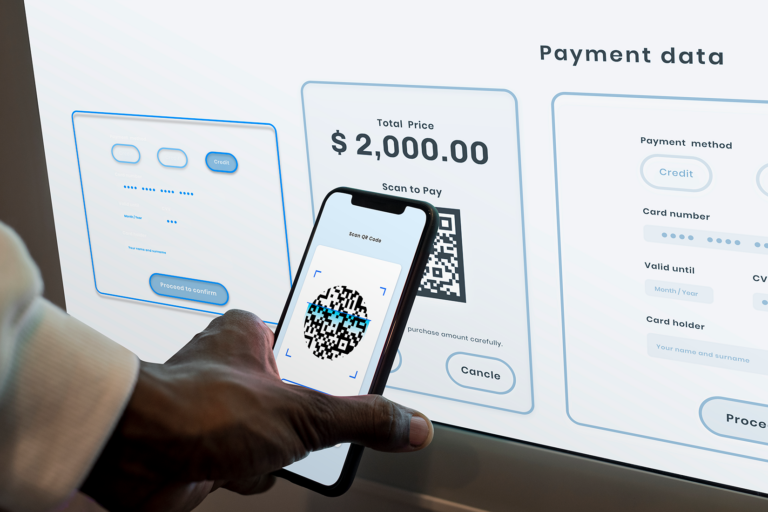

The 10-year FDIC survey revealed that mobile banking has seen tremendous growth as a preferred method of account access. In 2015 only 9.5% of respondents identified mobile banking as their primary service channel. That number rose rapidly to 15.6% in 2017 and 34.0% in 2019.

These trends were punctuated by the COVID-19 pandemic and subsequent lockdowns. Similar to remote work and telehealth, mobile banking saw massive adoption, even among older users. 43% of consumers surveyed in the EY Future Consumer Index said the way they bank has changed due to COVID-19. Financial institutions that made significant investments in their online and mobile banking platforms were most prepared for the consumer shift.

Despite trends toward online and mobile banking, the branch visit remains important. Even in the final year of the FDIC’s decade-long survey, 83% of banked households reported speaking with a teller or other employee at their local branch. Even among consumers who claimed their most-used banking method was the mobile app, 79.9% said they visited a physical branch location, and 18.8% visited ten times or more.

What Do National Trends Mean for Your Branch Network?

When NewGround partners with financial institutions to develop a custom branch strategy, we consider broad consumer trends along with relevant local factors. The shift to online and mobile banking might make it seem like the old-fashioned branch visit has become less relevant, but in fact, this is not the case.

Consumers are still utilizing their local branches. With fewer in-person visits, financial institutions have to make their impressions count. Branch locations are challenged to craft a new consumer experience that accounts for the change in foot traffic and the safety concerns of visitors. Physical store locations are adapting to complement online and mobile banking experiences, while seizing any opportunity to establish and maintain trust among those they serve.

One of the most-cited reasons why “unbanked” consumers said they did not have a bank account was their lack of trust in the banking system. In order to challenge this lack of trust and win customers, financial institutions must prioritize their branch strategy.

You can gain valuable insights about your institution today. With your free Branch Growth Snapshot from NewGround, you will obtain a thorough assessment of your organization’s performance and potential in your unique market.

Strategy is powered by data. Don’t delay getting the information you need to build a strategy for your branch network.