Executive Summary

Dr. William G. Dean, Scott Florini, and Evan Briddle

Bank branches encompass many elements that influence overall performance. Success rates include measurable market factors, such as the growth of the local economy, in addition to intangibles, such as the branch and sales staff’s acumen.

Similar to other retail businesses, such as restaurants, department stores, or convenience stores, success or failure largely depends on specific variables. Examples include:

- The physical location;

- The visibility;

- Commuting patterns; and

- The convenience to a targeted market segment

How It Impacts Performance

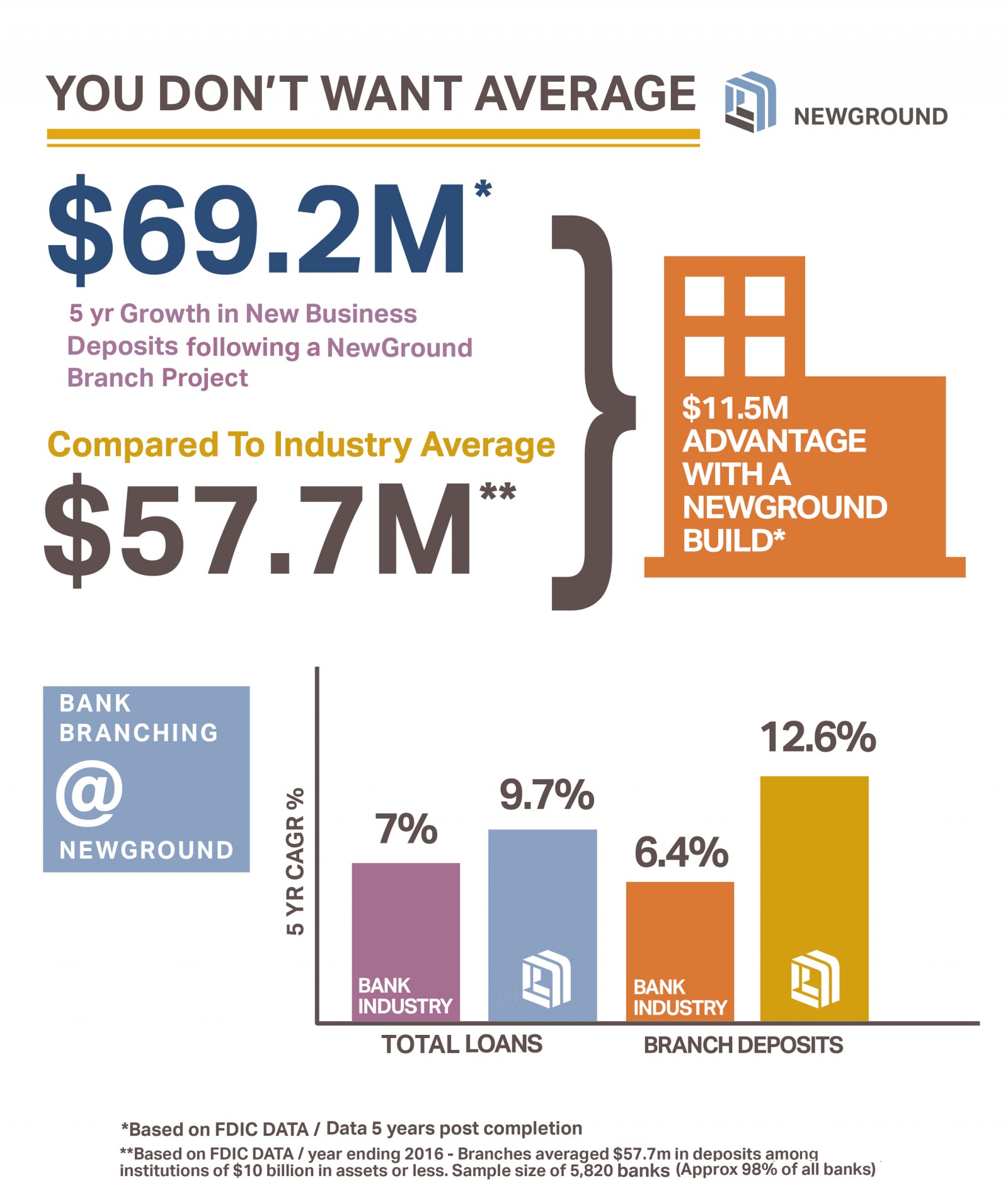

From 2000 until 2010, NewGround conducted a study that analyzed deposit and loan growth for NewGround’s banking clients versus the banking industry averages for the same time period. Eighty NewGround branch projects were analyzed and compared to an industry sampling of 5,820 banks, with assets of $10 billion or less (FDIC, 2016). The data used was based on a five-year post-completion assessment of growth for both groups.

The NewGround Advantage

As evidenced in the figure below (Fig. 1), findings revealed that NewGround clients had a five-year growth in new business deposits of $69.2 million versus the industry average of $55.7 million—or an approximate 20 percent improvement. Additionally, NewGround found a five-year compound annual growth rate (CAGR) of 9.7% for NewGround client’s total loans versus 7% for the industry, and 12.6% for NewGround client’s deposits versus 6.4% for the industry.

Fig. 1: Advantage with a NewGround Build

Source: NewGround Strategy (2017)

Factors Influencing Results

Influencing factors are inclusive of economic trends, client operations and cultures, and regulatory changes within the industry (e.g., M&As, TARP, Dodd-Frank). Using a strategy-first, customer-focused experiential approach to physical environments might generate a higher return on deposits and loans with clients who opt to transform their value and brand in both physical and virtual environments.

This study is limited by the data reported by these institutions through FDIC. However, it is inferred that the influence of strategy-driven experience design and integrating customer points-of-experience into the physical ‘floor plate’ environment meets the criteria of creating enhanced customer value. Numbers can be taken at their relative face values, and the results of this study infer that transforming business models to create consumer experiences and delivering that strategy through improved physical environments produces positive results.

The Customer Experience Impact

Banking has measured customer satisfaction to quantify how retail environments affect consumer behaviors. Reviewing recent articles has proven that one thing has remained constant; the customer experience transcends all industries. In fact, today we live in a world in which our decisions and satisfaction are fueled by micro-experiences.

Satisfaction is an important result of the consumer experience in banking (Keisidou et al., 2013; Seiler et al., 2013). Banking-specific analyses can be construed as antecedents and congruencies relative to customer satisfaction (Laderia, Santini, Sampaio, Perrin, and Araujo, 2016). Satisfaction becomes one of the most commonly used metrics to guide loyalty and service efforts in banks (Askoy, 2014; Laderia et al., 2016).

Banks have traditionally viewed the branch environment as a crucial element in acquiring and retaining customers (Greenland and McGoldrick, 2005).

Renaires and Garcia (2012) discussed the need for banks to examine their retail environments to improve the frequency of customer visits and to avoid the commoditization of both brands and companies (p. 377).

The concept of “embracing clients and having them embrace back”, proposes a need for a more robust consumer experience (Mitchell, 2003; Renaires and Garcia, 2012, p. 377).

The concept of embracing customer experiences becomes a two-fold approach when the consumer interacts with the physical environment of a store and its staff through practices and procedures (Arnold et al., 2005; Grace and O’Cass, 2004; Ofir and Simpson, 2007; Renaires and Garcia, 2012).

Brand Experience

As disciples of B. Joseph Pine and James H. Gilmore, authors of The Experience Economy (1999, 2011), “Work is Theater & Every Business is a Stage,” your brand should come alive and create a jaw- dropping experience in which the client fully understands just how different you are.

The concept of brand experience engages the internal reaction of a consumer when behavior is triggered by stimuli associated with the brand, such as design of the brand identity, packaging, attributes, and information (Brakus et al., 2009).

The bad news is that today we are all competing against Disney-like experiences. World class service abounds in best-of-class organizations and raises our expectations to what service could be like and should be like. The consumer experience has become holistic and contains cognitive, affective, emotional, social, and physical reactions by the consumer to the retailer as documented by Renaires and Garica, 2012.

The physical bank branch is far from dead—it has just changed. The fact is that the physical environment is the cornerstone to engage with clients in mitigating problems and issues, and conducting complex and important milestone decisions (mortgage, wealth management, and commercial loans).

Frequency is the new paradigm shift with staff that is more relational-based and knowledgeable across multiple platforms.

Greenland and McGoldrick (2005) studied United Kingdom bank customers and confirmed a Key Note (2003) and Banker (2004) analysis that the branch remains the most important distribution tactic. Temessek (2009) further confirmed that physical banking environments are at the “core of the service” (cited by Renaries and Garcia, p. 380).

Banks are still evaluating the costs of branch renovation relative to money and effort, without fully appreciating how these new designs or their features will impact the branch users (Greenland and McGoldrick, 2005).

Studies have attempted to evaluate branches as a whole, rather than focus on individual aspects, such as environments, physical and functional dimensions, affective responses, and conceptual frameworks. Strategic branching is still a tool in the toolbox to create growth.

All Things Being Equal, We Do Business with Our Friends

When we create long lasting relationships, we can mitigate occasional service issues and blips in service delivery. Doing nothing to upgrade current environments and engagement is a recipe for flat results.

Banking relationships in financial service providers often serve as only utility providers, meaning one thinks about them only when they receive a bill (Ferguson and Hlavinka, 2007).

Alternative financial service providers have caused customers to become conditioned to shop around for the best banking options, so that consolidation of services is rarely considered (Ferguson and Hlavinka, 2007).

For most industries, executives are “shocked” when clients go away. Without paying careful attention to relationships, you will operate at a deficit. Unless your staff creates confidence and “trust”—and owns the relationship and treats clients just like the first day they “won” the relationship— you are at jeopardy of losing them. Watching your relationship balance sheet is mission critical.

A Bank Administration Institute (BAI) study conducted in 2005—with NewGround sponsorship—indicated “BAI’s analysis found that, while banks view relationships in terms of the number of products a customer has with the bank, consumers view relationships in terms of confidence and trust” (Ferguson and Hlavinka, 2007, p. 112).

Symonds, Wright, and Ott (2007) discussed customer-led banking and how these banks retain and grow their customer base. Focused on the “cost of losing” a long-tenured profitable customer, bankers acknowledge that their account holders need a better customer experience (p. 5).

The cost to winning a client versus retaining an existing one remains six to seven times more expensive.

It is not surprising that bankers surveyed overwhelmingly rated managing the customer experience as the most important factor for success (Symonds et al., 2007, p 5).

Strategy First

Strategy must lead customer experience environments and retention by integrating experiences into the business model and understanding that customers want personable and memorable experiences that create loyalty.

Chase and Dasu (2014) referenced Pine and Gilmore’s The Experience Economy indicating that clients are willing to pay a premium for memorable experiences. Experiences are closely related to perceptions of service in three ways, emotions, trust, and control (Chase and Dasu, 2014).

Services are human-laced puzzle environments, where success depends on relationships, and offering outstanding products and services. People complicate the equation by being unpredictable, temperamental, irrational, occasionally crazy, and frustrating. Creating an experience that maximizes a positive emotion is a deal changer for an organization.

Emotions influence what we remember, how we score and encounter, and the decisions we make (Chase and Dasu, 2014, p. 575). Emotionally-charged events are easily recalled. Trust develops when engagement outcomes are not completely under the service provider’s control and the customer has no access to provider’s skills or knowledge. Competence and motivation are key differentiators (Chase and Dasu, 2014). Control allows customers to either have direct control over the process, feel that things are in control when one cannot directly influence the process, or “know that someone is maintaining order and apprising customers of the changing situations” (Chase and Dasu, 2014, p. 576).

NewGround believes that “Leading with Strategy” includes many elements of designing the customer experience and delivering on the “experience demographics” of service management (Chase and Dasu, 2014, p. 577).

Understanding the customer’s emotional mindset at the physical encounter is a function of demographics, psychographics, previous encounters, and understanding the consumer journey, stated by Pine and Gilmore (2016) (p. 8).

Using an experiential-based client approach, NewGround initiates strategy through a proprietary journey mapping process that addresses key points-of-experience touchpoints (zones) within the branch environment identified as:

- Attract;

- Engage;

- Transact;

- Consult; and

- Staff Needs.

Developing a needs matrix allows clients to understand the dynamics that need to occur at each zone to achieve desired customer experiences. These activities vary for individual expectations, whether they are ‘self-helpers’ or ‘help-seekers’ (NewGround). NewGround strongly believes that the customer experience is connected to performance.

Let’s Talk.

Through over 100 years of innovation, NewGround has driven the conversation on facility design for financial institutions. We believe that structures without strategic purpose are just windows and walls, and that in order to uncover the ideal solution you must start with your brand and your culture.

When considering a project as complex as a new building or major renovation, it’s never too early to begin strategizing. We can help.

To learn more about bank statistics, visit our website or contact us:

NewGround

636.898.8100

888.613.0001

www.newground.com

Appendix

Works Cited

Askoy, L. (2014). Linking satisfaction to share of deposits: an application of the Wallet Allocation Rule. International Journal of Bank Marketing, 32(1), 28-42.

Arnold, M. J., Reynolds, K. E., Ponder, N., and Lueg, J. E. (2005). Customer delight in a retail context: investigating delightful and terrible shopping experiences. Journal of Business Research, 58(8), 1132-1145.

Baker, J., Berry, L. L., and Parasuraman, A. (1998). The marketing impact of branch facility design. Journal of Retail Banking, 10(2), 33-42.

Brakus, J. J. S., Schmitt, B. H., and Zarantonello, L. (2009). Brand experience: what is it? How is it measured? Does it affect loyalty? Journal of Marketing, 73(3), 52-68.

Chase, R. B., and Dasu, S. (2014). Experience psychology – a proposed new subfield of service management. Journal of Service Management, 25(5), 574-577.

Donovan, R. J., and Rossiter, J. R. (1982). Store atmosphere: and environmental psychology approach. Journal of Retailing, 58, 34-57.

Federal Deposit Insurance Corporation (FDIC) (2016). www.fdic.gov.

Ferguson, R., and Hlavinka, K. (2007). Choosing the right tools for your relationship banking strategy. Journal of Consumer Marketing, 24(2), 110-117. doi: 10.1108/0736376071073111.

Grace, D., and O’Cass, A. (2004). Examining service experiences and post-consumption evaluations. The Journal of Services Marketing, 18(6), 450-461.

Greenland, S., and McGoldrick, P. (2005). Evaluating the design of retail financial service environments. The International Journal of Bank Marketing, 23(2), 132-152. doi: 10.1108/0265230510584386.

Huang, M. H. (2003). Modeling virtual exploratory and shopping dynamics: An environmental psychology approach. Information and Management, 41(1), 39-47.

Keisidou, E., Saragiannidis, L., Maditinos, D. I., and Thalassinos, E. I. (2013). Customer satisfaction loyalty and financial performance: a holistic approach of the Greek banking sector. International Journal of Bank Marketing, 31(4), 259-288.

Key Note (2003). Personal Banking. Key Note Limited, Hampton, UK.

Laderia, W. J., Santini, F. D. O., Sampaio, C. H., Perrin, M. G., and Arajuo, C. F. (2016). A meta-analysis of satisfaction in the banking sector. International Journal of Bank Marketing, 34(6), 798-820. doi: 10.1108/IJBM-10-2015-0166.

Mitchell, J. (2003). Hug your customers. New York: Hyperion Books.

Mylonakis, J., Malliaris, P., and Siomkos, G. (1998). Marketing-driven factors influencing savers in the Hellenic bank market. Journal of Applied Business Research, 14(2), 109-116.

Ofir, C., and Simonson, I. (2007). The effect of stating expectations on customer satisfaction and shopping experiences. Journal of Marketing Research, 44(1), 37-72.

Parente, E. S., Costa, F. J., and Leocadio, A. L. (2015). Conceptualization and measurement of customer perceived value in banks. International Journal of Bank Marketing, 33(4), 494-509. doi: 10.1108/IJBM-04-2014-0051.

Pine, B. J., and Gilmore, J. H. (1999). The experience economy: Work is theatre and every business a stage. Boston: Harvard Business School Press, updated version: The experience economy, Boston: Harvard Business School Press, 2011.

Pine, B. J., and Gilmore, J. H. (2016). Integrating experiences into your business model: Five approaches. Strategy and Leadership, 44(1), 3-10. doi: 10.1108/SL-11-2015-0080.

Reinares, P., and Garcia, L. (2012). Methods of improving the physical spaces of banking establishments. International Journal of Bank Marketing, 30(5), 376-389. doi: 10.1108/02652321211247426

Selier, V., Rudolf, M., and Krume, T. (2013). The influence of socio-demographic variables on customer satisfaction and loyalty in the private banking industry. International Journal of Bank Marketing, 31(4), 235-258.

Symonds, M., Wright, T., and Ott, J. (2007). The customer-led bank: How to retain customers and boost top-line growth. Journal of Business Strategy, 28(6), 4-12. doi: 10.1108/02756660710835851.

Temessek, A. (2009). L’environment physique des services: Synthese et analyse conceptuelle. Revue Francaise des Marketing, 225(5), 33-49.

(The) Banker. (2004). Branches aim for efficiency. The Banker, 118.