The ability to adapt effectively offers an advantage in any market. For example, points of contact with consumers have to meet and exceed expectations that are constantly changing. As consumers increasingly turn to digital-first banking experiences, the need for flexibility in financial institution design has never been more critical. Spaces that can evolve alongside industry standards can help financial institutions center the needs of their consumers and prepare for the future.

The Need for Flexibility in Branch Design

Traditional branch models are being challenged by the rapid pace of digital transformation within the banking industry. To remain competitive, financial institutions must adopt flexible branch designs that can accommodate both digital transactions and essential advisory services. NewGround recognizes the challenges facing financial institutions and offers tailored solutions to meet their evolving needs. Our flexible branch designs enable institutions to respond quickly to changing market trends and consumer behaviors, ensuring they stay ahead of the curve.

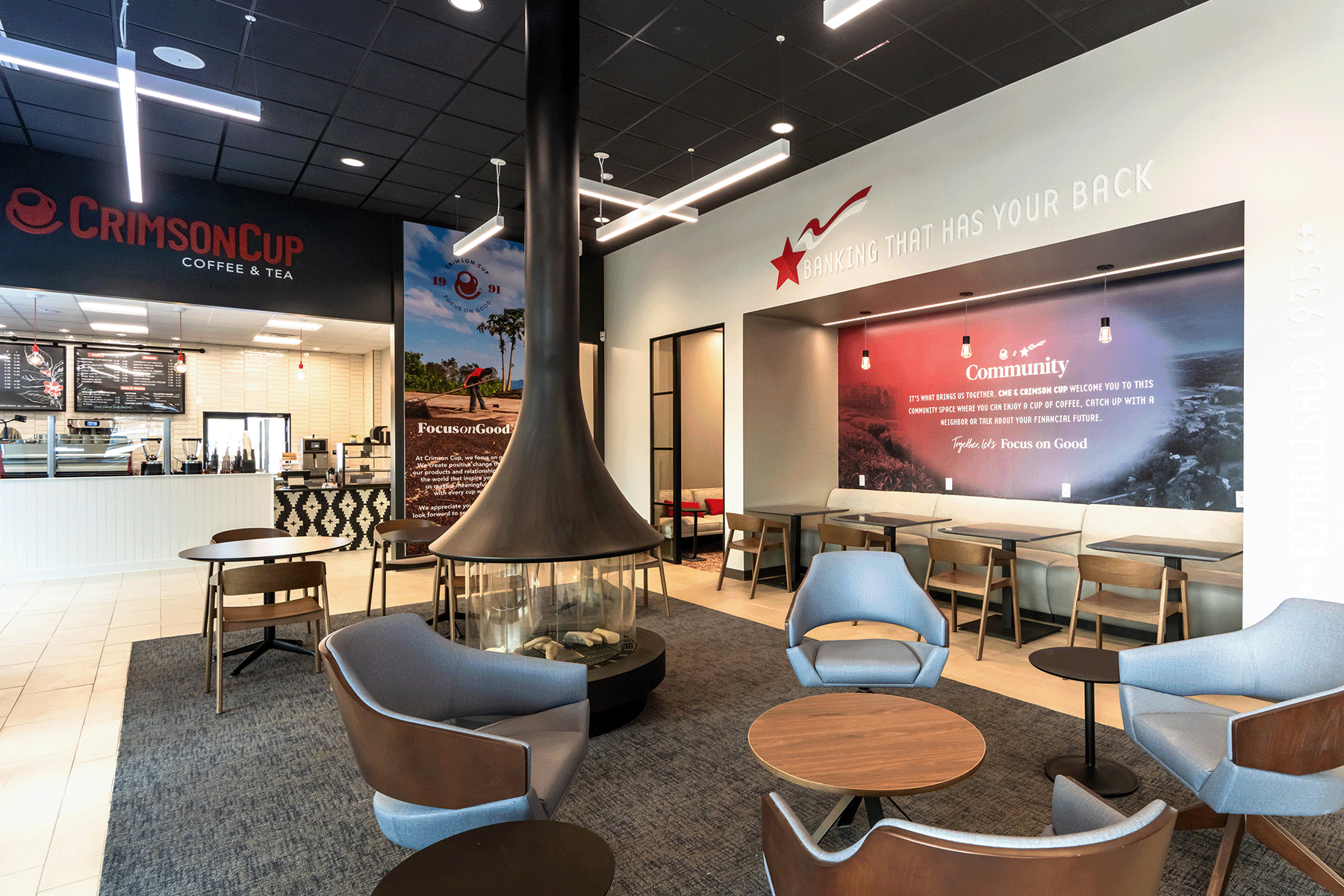

From our work: NewGround empowers Santander Bank with a flexible and intuitive customer journey.

Modular Banking: Empowering Financial Institutions with Customization

With a modular framework, financial institutions can tailor their product offerings to meet the unique needs and preferences of their diverse customer base. This flexibility enables banks and credit unions to create personalized solutions that resonate with customers on a deeper level, fostering stronger relationships and driving consumer loyalty.

Through modular banking, financial institutions gain the ability to adapt quickly to evolving market trends and consumer demands. NewGround’s expertise in modular design allows institutions to seamlessly integrate new features and services into their existing offerings, without the need for costly core conversions. This modular approach enables institutions to stay ahead of the curve, providing consumers with the latest innovations and technology-driven solutions. By embracing modular banking, financial institutions can unlock new opportunities for growth and differentiation in an increasingly competitive landscape.

Enhance Back-Office Spaces with Flexible Design

Flexible design principles offer numerous benefits for back-office spaces. By embracing adaptable layouts and versatile furniture solutions, these areas can easily accommodate changing needs and functions without the need for extensive renovations. Workspaces for hybrid staff, who only spend part of their time in the office, can be optimized through flexible design. It can also enhance collaboration and communication among team members with the ability to create shared workspaces.

From our work: NewGround partners with Fort Sill Federal Credit Union to bring flexible design to their headquarters.

![]() As the banking industry continues to evolve, flexibility in design will be essential for financial institutions to stay competitive and meet the needs of their consumers. At NewGround, we are committed to helping our clients navigate this changing landscape with innovative design solutions that prioritize flexibility, customization, and customer experience. Contact NewGround today to learn how our design, build, and strategy services can help your institution thrive in the digital-first era of banking.

As the banking industry continues to evolve, flexibility in design will be essential for financial institutions to stay competitive and meet the needs of their consumers. At NewGround, we are committed to helping our clients navigate this changing landscape with innovative design solutions that prioritize flexibility, customization, and customer experience. Contact NewGround today to learn how our design, build, and strategy services can help your institution thrive in the digital-first era of banking.